Our smart sx technology

What makes our Smart SX Technology the most sustainable, high purity alumina process technology in the world? Watch our short video to find out.

Alpha HPA delivers the low cost, high demand, critical ingredient for revolutionary energy storage and other breakthrough technologies via our Smart SX Technology, with enviable green credentials. Invest in a future where smart technology enables innovation and growth by way of the world’s most sustainable HPA products.

Alpha HPA’s Smart SX Technology delivers some of the highest purity aluminium products in the world, at world-leading margins in a first class jurisdiction and with a very low carbon footprint.

Alpha HPA’s products are in growing demand as the world’s technologies and governments respond to a once in generational technology shift to meet the challenges of de-carbonisation

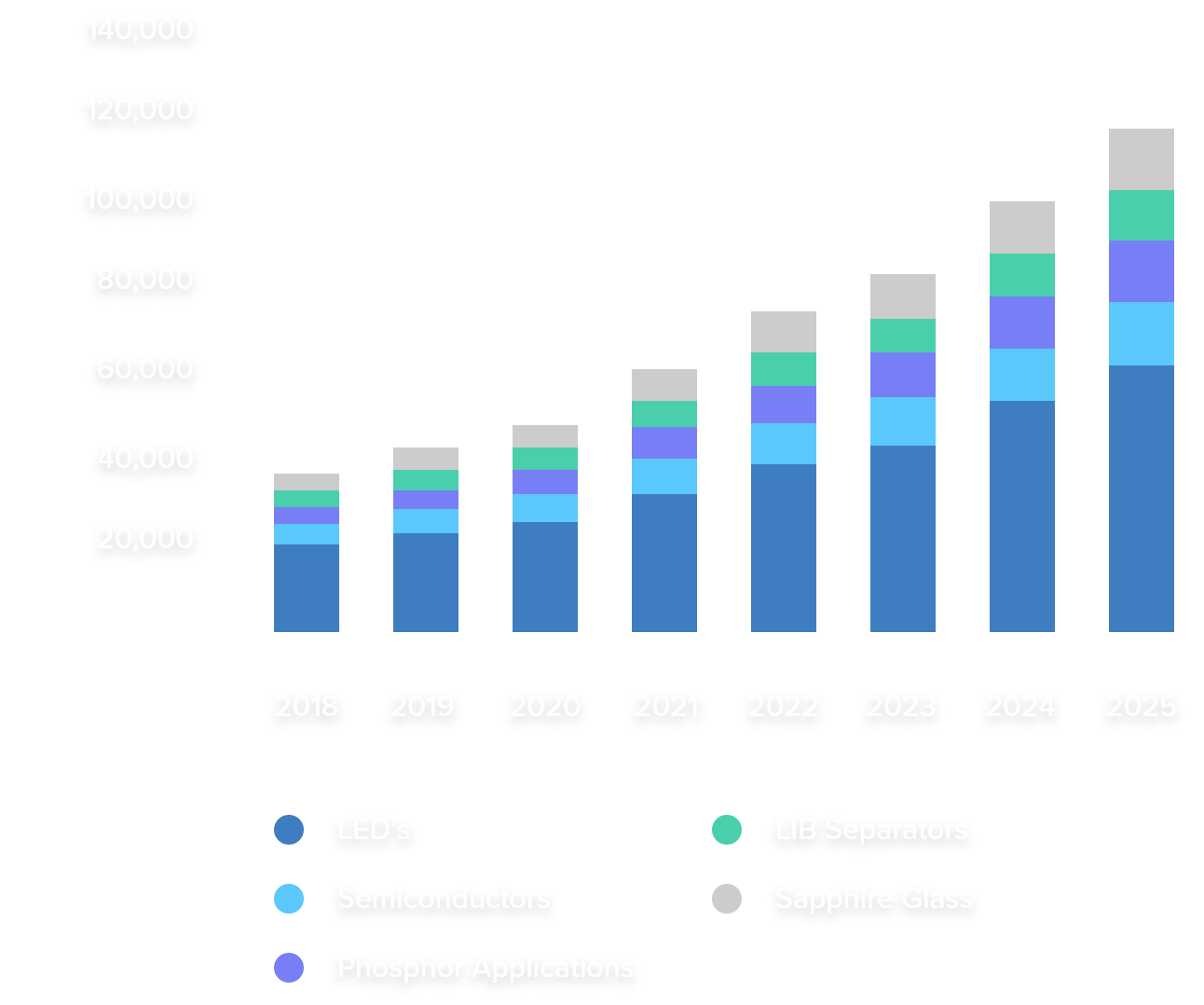

As global markets demand cleaner energy solutions, manufacturers of Lithium-based energy storage solutions, LED lights and Smartphones are demanding HPA. To 2025, the total HPA compound annual growth rate is forecast to be 17.5%. Looking at electric vehicles alone, growth demand for HPA as a key material is forecast to increase by 400%.

Our efficiencies impact more than the bottom line. They align with the markets that we’re delivering into—the markets that are driving decarbonisation. The revolution in energy storage, the global adoption of LED lights and the demand Smartphones is not separate to the increasing call for greener practices, and in the production sustainable high purity alumina, Alpha HPA leads the way.

Demand for HPA is primarily being driven by the increasing adoption of LED (Light Emitting Diode) products, separators in lithium ion batteries (Li-B’s) and scratch resistant artificial sapphire glass for Smartphone screens and watches.

Growth demand is dominated by the APAC Region (~70% in 2016) primarily China, Japan and South Korea. Alpha HPA is ideally placed to service the most dominant region of global HPA demand.

Information as at 30 September 2024.

Distribution of Equity securities

Range Number of Holders Number of Shares 1- 1,000 857 536,743 1,001- 5,000 1,696 4,667,178 5,000- 10,000 824 6,570,031 10,001- 100,000 1,567 55,786,097 100,001- and over 492 1,067,020,644 Total 5,436 1,134,580,693The number of shareholders holding less than a marketable parcel at 30 September 2024 is 159.

Substantial Shareholders Substantial shareholders and the number of equity securities in which it has an interest, as shown in the Company’s Register of Substantial Shareholders is:

Shareholder Number Held Regal Funds Management Pty Ltd (RFM) 70,916,053 Macquarie Group Limited 70,014,040 Permgold Pty LtdAustralianSuper Pty Ltd 67,291,194

56,910,996 Orica Limited and Orica Investments Pty Ltd 44,982,980

Class of Shares and Voting Rights

The voting rights attached to ordinary shares, as set out in the Company’s Constitution, are that every member in person or by proxy, attorney or representative, shall have one vote when a poll is called, otherwise each member present at a meeting has one vote on a show of hands.

Current as at 30 September 2024.

Alpha HPA Limited Level 2, 66 Hunter Street Sydney, NSW, 2000

Telephone: +61 (0) 2 9300 3310 Facsimile: +61 (0) 2 9221 6333

Computershare Investor Services Pty Limited Level 4, 60 Carrington Street Sydney, NSW, 2000

Telephone: 1300 787 272 Overseas Callers: +61 3 9415 4000 Facsimile: +61 (3) 9473 2500 Email: web.queries@computershare.com.au

KPMG 16 Riparian Plaza 71 Eagle Street Brisbane, QLD, 4000

A copy of the Annual Report can be downloaded in the Report and Announcements section of this website.

The report is available for download in Adobe Acrobat format. You will need to have Adobe Acrobat Reader installed on your computer to view it.

To install Adobe Acrobat Reader please go to: http://www.adobe.com/ Alternately, printed copies of the Annual Report can be mailed out. If you would like a printed copy of the report, please contact us.

Our financial year ends 30 June in each year.

These announcements are available in the ASX Announcements section of Alpha HPA Limited’s website or by accessing the archive section of the Australian Stock Exchange – ASX: A4N. Click here to view.

Please view our Capital Structure page for information on Ordinary Paid Shares.

Yes, you can register to receive alerts by email from Alpha HPA Limited. As and when ASX Announcements are posted, we will publish them on the website and send them to your preferred email address. To subscribe for email alerts click here.

HPA First Project is Smart SX Technology in action, and at scale. Solvent extraction has long been a method for extracting and purifying metals, but it’s not been successfully applied to aluminium until now. With the HPA First Project, we’re applying our licensed solvent extraction and refining technology to produce >99.99% pure aluminium products from a common industrial feedstock.

View Products

What makes our Smart SX Technology the most sustainable, high purity alumina process technology in the world? Watch our short video to find out.